Your business. Your truck. Your protection.

The best insurance starts here.

Explore our products

Explore our tailored commercial insurance services for truckers and small businesses, ensuring reliability and trust.

TRUCKING INSURANCE

Trucking insurance is specialized coverage for commercial trucks and drivers. It protects against accidents, cargo loss, physical damage, and liability claims, ensuring owner-operators and fleets stay protected while hauling on the road.

SMALL BUSINESS INSURANCE

Small business insurance is protection designed to cover the unique risks that business owners face. Protect your company with affordable small business insurance tailored to your needs.

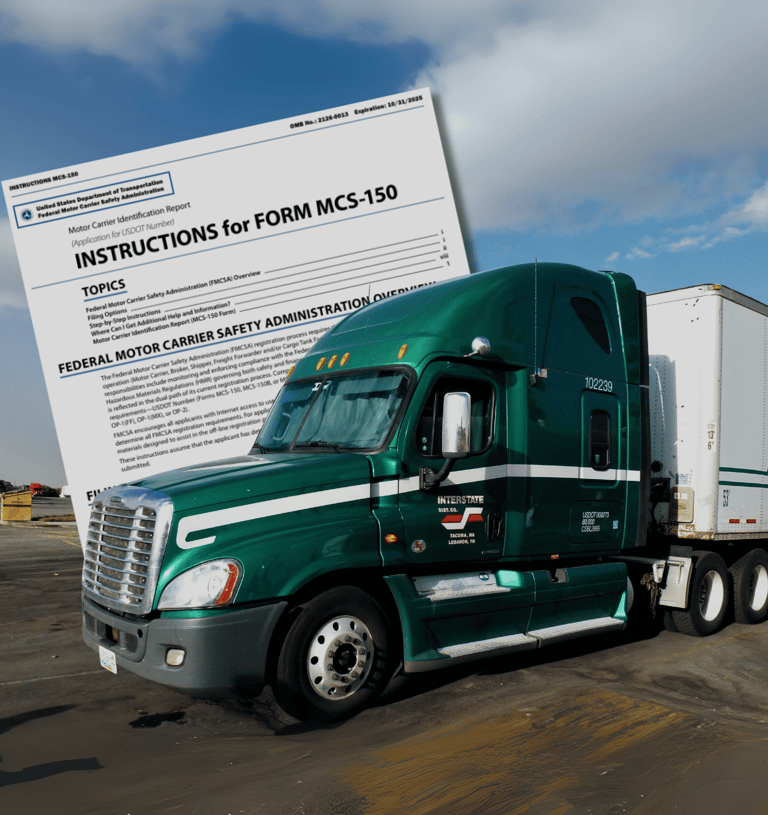

TRUCKING PERMITS

Trucking permits are the official authorizations that allow your trucking business to operate legally across states. Stay compliant and keep your trucks on the road with our trucking permit services.

LOOKING TO START YOUR TRUCKING COMPANY?

You didn’t come this far to stop. Let's create it!

Best Commercial Insurance for TRUCKERS & SMALL BUSINESSES

Contact

© 2025. Total Global Solutions Inc DBA Total Global Insurance Services - All Rights Reserved.

Trust

3230 E Imperial Hwy. Suite 300

Brea CA - 92821

CA License# 6015423

quick links

🗣 Se habla Español